Categories

Categories

Trade wars are well-known causes of economic tensions between countries; their effect can be felt across much on the economic shelf. One of the casualties of such geopolitical struggles is the change in the global gemstone market which is a fragile, interrelated network of producers, cutters, traders and retailers. When trade barriers are erected or trade relations get spoilt, the ripple effect can greatly hurt gemstone market pricing, supply, and acquisition methods across the world.

What is the reshuffled gemstone industry due to trade wars, especially the national trade policies higher tariffs by the USA? Let's discuss.

The gemstone marketplace is, by definition, international. A single stone may be mined in Africa, cut in Thailand, polished in India and sold in the United States. This elaborate supply chain relies on the smooth existence of international collaboration. Trade wars destroy this flow, and in its place, tariffs, delays, and uncertainty are introduced at every step.

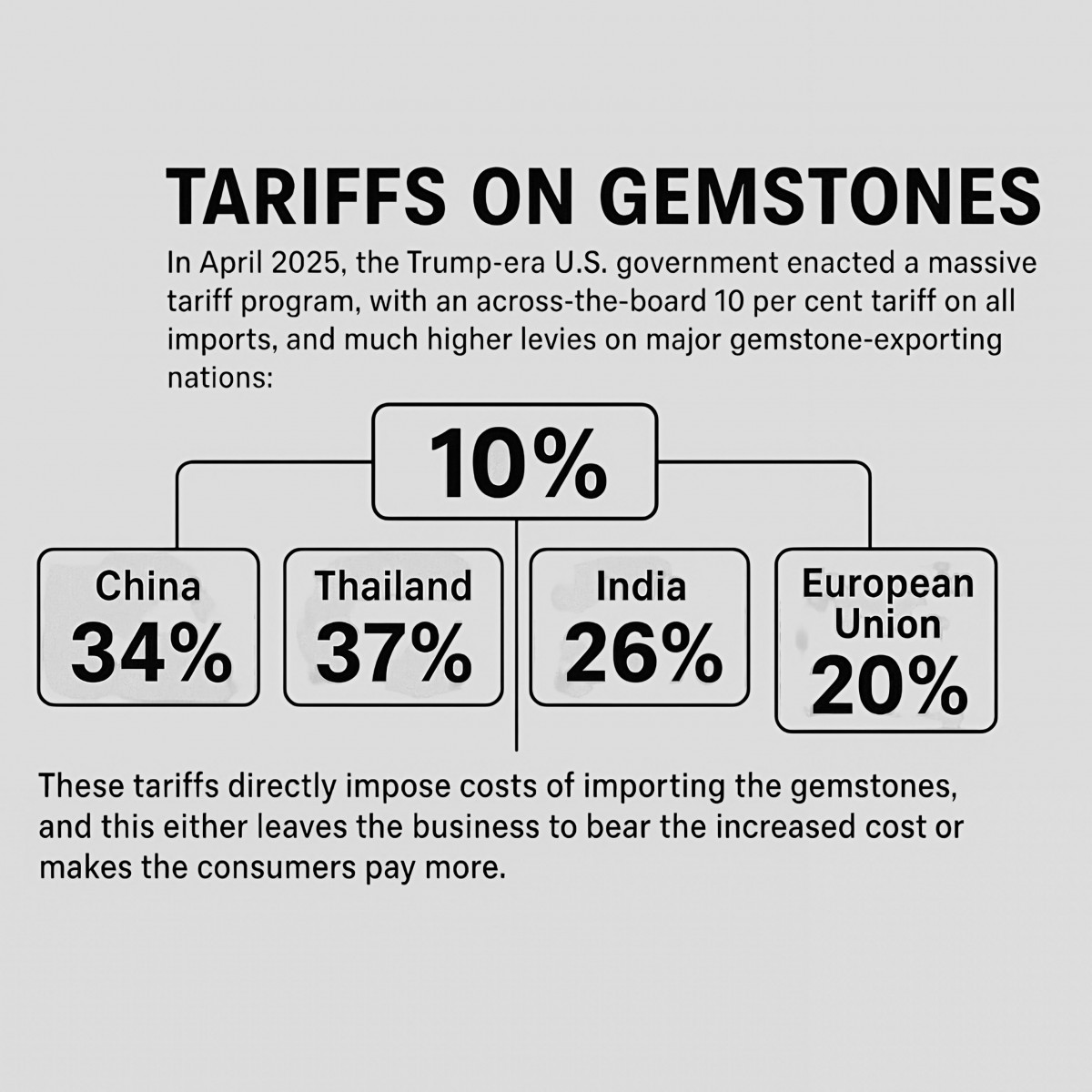

In April 2025, the Trump-era U.S. government enacted a massive tariff program, with an across-the-board 10 per cent tariff on all imports, and much higher levies on major gemstone-exporting nations: China (34 per cent), Thailand (37 per cent), India (26 per cent), and the European Union (20 per cent). These tariffs directly impose costs of importing the gemstones, and this either leaves the business to bear the increased cost or makes the consumers pay more.

The gemstone and jewelry business in India exports about 32billion USD every year, and the U.S. alone gets almost 10billion. Even the highly important trade relationship is jeopardised by the 26 per cent tariff imposed on Indian exports. Since the diamond cutting and polishing industry of India provides millions of jobs, the impact may be disastrous to the economy. There is already the loss of jobs, curtailed investments as well as disruption in the supply chains.

Thailand, like other countries which specialize in colored gemstone processing, particularly in ruby stone and sapphires, is forced to pay a 37 per cent tariff. The University of the Thai Chamber of Commerce claims such tariffs will cost the country up to 359 billion baht and cause a decrease in GDP by 2%.

Bangkok-based small and mid-sized jewelry firms that depend so much on orders of the U.S market are especially exposed.

China, another powerhouse in the processing of gemstones, decided to fight a tariff war by imposing tariff retaliation on U.S. products in the same way. Such tit-for-tat escalation has resulted in higher expenses on the part of the U.S. importers, and many are switching to other suppliers. The result? Redistribution of trade patterns and alliances on a global scale, which has long-term effects on prices and availability.

The tariffs would increase the costs incurred by U.S.-based jewelers in the importation of gemstones. Increase selling prices and run the risk of losing customers, or eat the increase. Smaller companies are the ones who cannot handle these changes enough to have some financial padding.

One jeweler in the United States, said that projects in which they have got stones in Thailand are now loss-making as a result of tariffs. It is a mess, he said, and putting more of that on the consumer is the dilemma the company will face.

Besides the price and traveling conditions, there are human costs of trade wars. A lot of the places that mine gemstones also use the trade to subsidise their communities. Unexpected changes in trade policy would rather ruin the artisanal mining communities in Tanzania and Kenya. These communities have subsistence economies and these communities can be affected by shocks to demand quickly and drastically.

All indicators seem to be the same-while some leaders in the industry still hold a cautiously optimistic view towards any future trade agreement or exemption of gemstones, the consequences of the trade wars are already beginning to have a long-term implication on the industry. States can afford to diversify their export markets, U.S. firms can find alternative supply networks, and new trade blocs are possible.

The American Gem Trade Association is lobbying heavily to obtain tariff exemptions on loose colored gemstones, acknowledging the import-export nature of the business and the need to work with many international partners

Trade wars are not just political provocation; they are economic earthquakes that cause tremors even in the most specific sectors. To the gemstone market, they translate into an increase in prices, destabilisation of supply chains, and unstable populations. The coming adaptability in the industry will hinge on resiliency and innovation. Strategic sourcing, domestic options, and advocating policy - in both cases, stakeholders will have to negotiate through this tricky landscape carefully.

Ultimately, the shine of a gemstone can certainly still be shiny-but driving it resides a narrative that has been influenced by world politics, international economic policy and the timeless pursuit of beauty in perilous moments.

For more expert advice or consultation, visit Navratan, an online gem bazaar, where you will get authentic and lab-certified gemstones at the best prices.

Colored Gemstone Alternatives for Cushion Cut Diamond Ring Lovers

February 19th, 2026